monterey county property tax rate 2020

Web San Francisco ˌ s æ n f r ə n ˈ s ɪ s k oʊ. Louisianas median income is 54216 per year so the median yearly.

Monterey County Weekly Editorial Board S Endorsements In Local Regional Statewide And National Elections Cover Montereycountyweekly Com

Arizona is ranked 1632nd of the 3143 counties in the United States in order of the median amount of property taxes collected.

. 4 Proposition 30 Tax Millionaires for Electric. Web In 2020 the Supreme Court ruled that restrictions on when its leader can be removed were unconstitutional but rejected a plea to strike down the agency as a whole. Illinoiss median income is 68578 per year so the median yearly property.

The exact property tax levied depends on the county in Georgia the property is located in. Web The median property tax in Clark County Nevada is 1841 per year for a home worth the median value of 257300. The exact property tax levied depends on the county in Kansas the property is located in.

Illinois has one of the highest average property tax rates in the country with only six states levying higher property taxes. Web Monterey County Health Department continues to work with local medical providers to identify and test individuals included in the California Department of Public Healths priority groups for COVID-19 testing. Census Bureaus census-designated place of ArlingtonArlington County is considered to.

Web Pennsylvania is ranked 13th of the 50 states for property taxes as a percentage of median income. Douglas County collects on average 197 of a propertys assessed fair market value as property tax. Web Kansas is ranked 25th of the 50 states for property taxes as a percentage of median income.

The median property tax in Illinois is 173 of a propertys assesed fair market value as property tax per year. Davidson County has one of the highest median property taxes in the United States and is ranked 705th of the 3143. The county is situated in Northern Virginia on the southwestern bank of the Potomac River directly across from the District of Columbia of which it was once a partThe county is coextensive with the US.

Web Georgia is ranked 31st of the 50 states for property taxes as a percentage of median income. Missouris median income is 56517 per year so the median yearly property tax paid by. Web The median property tax in Mohave County Arizona is 916 per year for a home worth the median value of 170600.

Web The number of American households that were unbanked last year dropped to its lowest level since 2009 a dip due in part to people opening accounts to receive financial assistance during the. Web The median property tax in North Carolina is 078 of a propertys assesed fair market value as property tax per year. Davidson County collects on average 096 of a propertys assessed fair market value as property tax.

Web Tax amount varies by county. In the 2011. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143.

Web The median property tax in Douglas County Nebraska is 2784 per year for a home worth the median value of 141400. Louisiana has one of the lowest median property tax rates in the United States with only states collecting a lower median property tax than Louisiana. Web A footnote in Microsofts submission to the UKs Competition and Markets Authority CMA has let slip the reason behind Call of Dutys absence from the Xbox Game Pass library.

Web The states average property tax rate is 053. Spanish for Saint Francis officially the City and County of San Francisco is the commercial financial and cultural center of Northern CaliforniaThe city proper is the fourth most populous in California and 17th most populous in the United States with 815201 residents as of 2021. North Carolinas median income is 55928 per year so the median.

Part of its innovative design is protected by intellectual property IP laws. The data in this page characterizes who is being affected by COVID-19 in Monterey County. It covers a land area of 469 square.

Web The median property tax in Fulton County Georgia is 2733 per year for a home worth the median value of 253100. Fulton County has one of the highest median property taxes in the United States and is ranked 220th of the 3143 counties in order of. Web Arlington County is a county in the Commonwealth of Virginia.

The exact property tax levied depends on the county in Pennsylvania the property is located in. Web The median property tax in Louisiana is 24300 per year018 of a propertys assesed fair market value as property tax per year. Clark County collects on average 072 of a propertys assessed fair market value as property tax.

Johnson County collects the highest property tax in Kansas levying an average of 127 of median home value yearly in property taxes while Osborne County has. Web Microsoft has responded to a list of concerns regarding its ongoing 68bn attempt to buy Activision Blizzard as raised by the UKs Competition and Markets Authority CMA and come up with an. Chester County collects the highest property tax in Pennsylvania levying an average of 125 of median home value yearly in property taxes while.

Collin County collects on average 219 of a propertys assessed fair market value as property tax. Web The median property tax in Denton County Texas is 3822 per year for a home worth the median value of 178300. Ordinance amends Chapter 1060 of the Monterey County Code regulating noise.

Web The median property tax in Missouri is 091 of a propertys assesed fair market value as property tax per year. 2007 Effective January 1 2020 the Clark County sales and use tax rate increased to 8375. Web Seventy-six percent rate the nations economy as not so good or poor Thirty-nine percent say their finances are worse off today than a year ago.

Collin County has one of the highest median property taxes in the United States and is ranked 48th of the 3143 counties in order of. Douglas County has one of the highest median property taxes in the United States and is ranked 200th of the 3143 counties in order of. Mohave County collects on average 054 of a propertys assessed fair market value as property tax.

Missouri has one of the lowest median property tax rates in the United States with only fifteen states collecting a lower median property tax than Missouri. Denton County collects on average 214 of a propertys assessed fair market value as property tax. Web A MESSAGE FROM QUALCOMM Every great tech product that you rely on each day from the smartphone in your pocket to your music streaming service and navigational system in the car shares one important thing.

In September 2020 just before the 2020 general election Californians were also divided 47 optimistic 49 pessimistic. Web The median property tax in Davidson County Tennessee is 1587 per year for a home worth the median value of 164700. Denton County has one of the highest median property taxes in the United States and is ranked 77th of the 3143 counties in order of.

Web The median property tax in Collin County Texas is 4351 per year for a home worth the median value of 199000. An analysis from the law firm Ballard Spahr noted that the 5th Circuits decision applies only to federal district courts in Texas Louisiana and Mississippi. Clark County has one of the highest median property taxes in the United States and is ranked 546th of the 3143 counties in order of.

Fulton County collects on average 108 of a propertys assessed fair market value as property tax. Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. North Carolina has one of the lowest median property tax rates in the United States with only fourteen states collecting a lower median property tax than North Carolina.

Web The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. This is an increase of 18 of 1 percent on the sale of all tangible personal property that is taxable. Fulton County collects the highest property tax in Georgia levying an average of 108 of median home value yearly in property taxes while Warren County has.

Montereyherald Com Covers Local News In Monterey County California Keep Up With All Business Local Sports Outdoors Local Columnists And More

Treasurer Tax Collector Monterey County Ca

Orange County Ca Property Tax Calculator Smartasset

Treasurer Tax Collector Monterey County Ca

Homeownership Unaffordable But Declining Prices Provide Relief Attom

Property Tax Rates Berkshire County All Seasons Realty Group Berkshire Real Estate Homes For Sale In The Berkshires Pittsfield Ma Homes For Sale Homes Land Berkshire Real Estate Love Where You

California Property Tax Calculator Smartasset

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Monterey County Property Tax Guide Assessor Collector Records Search More

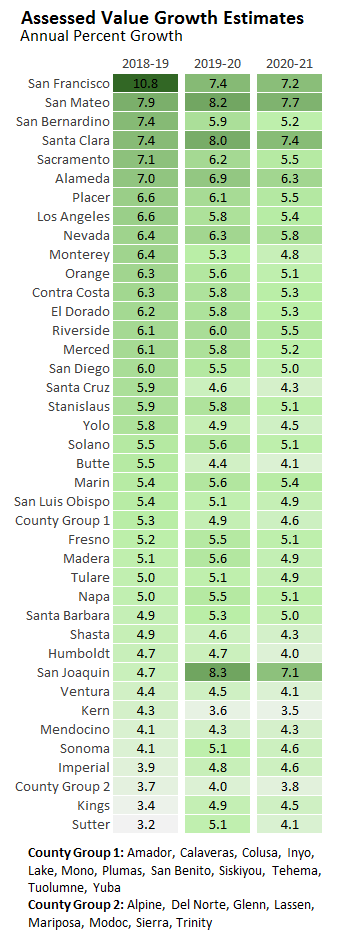

Fiscal Outlook Property Tax Estimates Exceed Budget Expectations Econtax Blog

Monterey County Fire Relief Fund Community Foundation For Monterey County

A Look At The Monterey County Measures On The Ballot Kion546

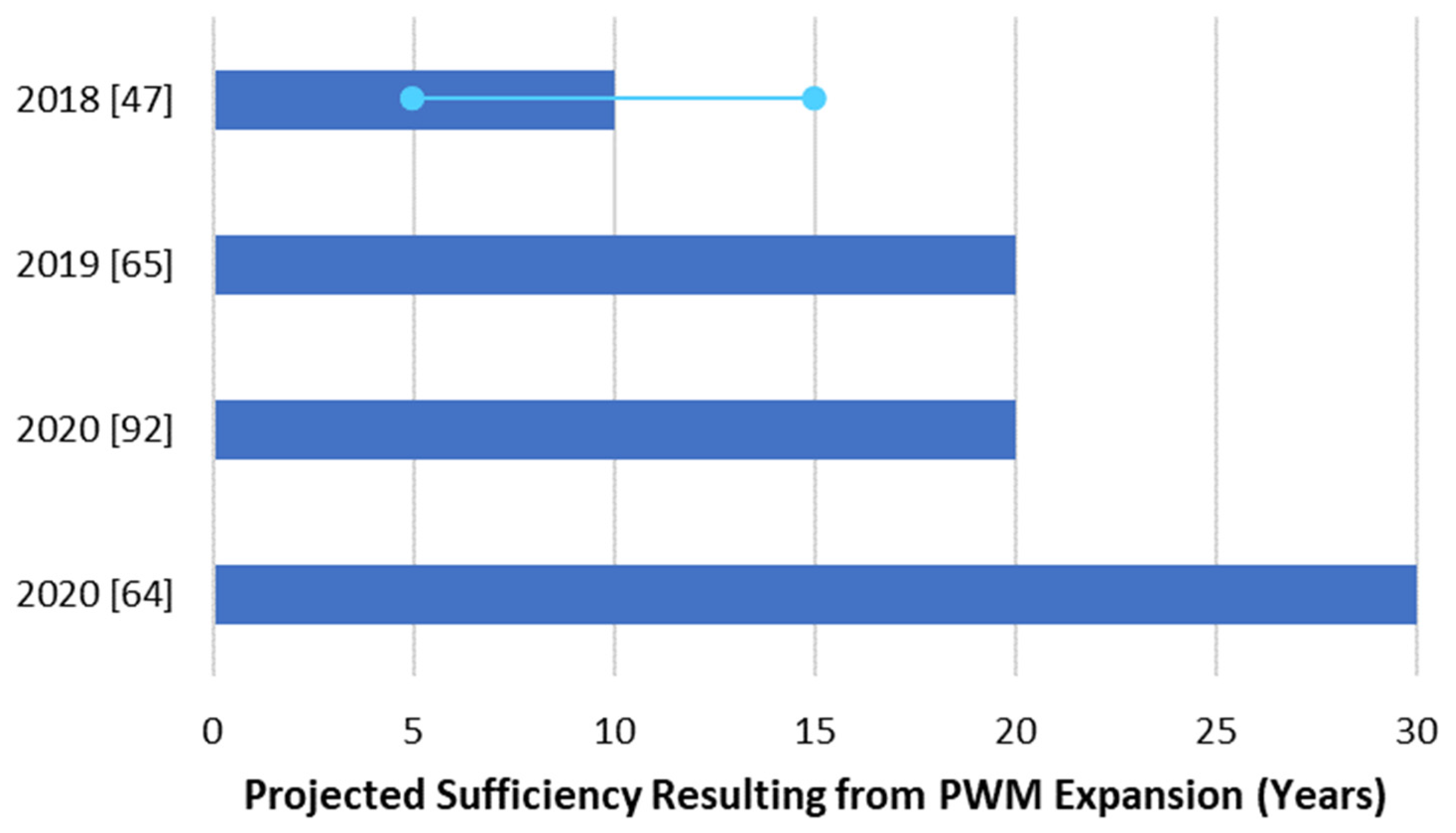

Water Free Full Text Integrated Water Management At The Peri Urban Interface A Case Study Of Monterey California Html

Highest And Lowest Property Tax Rates In Greater Boston Lamacchia Realty

Property Tax By County Property Tax Calculator Rethority

Monterey County On The State Watch List Access To All Local Beaches Closed This Weekend Voices Of Monterey Bay